When you subscribe to a mortgage in France, it is compulsory to subscribe to a borrower insurance (in case of death, working incapacities or disabilities)

Since the 1st of September 2022 and the Loi Lemoine, any borrower who has taken out a borrower insurance contract may terminate his/her borrower insurance contract at any time and free of charge.

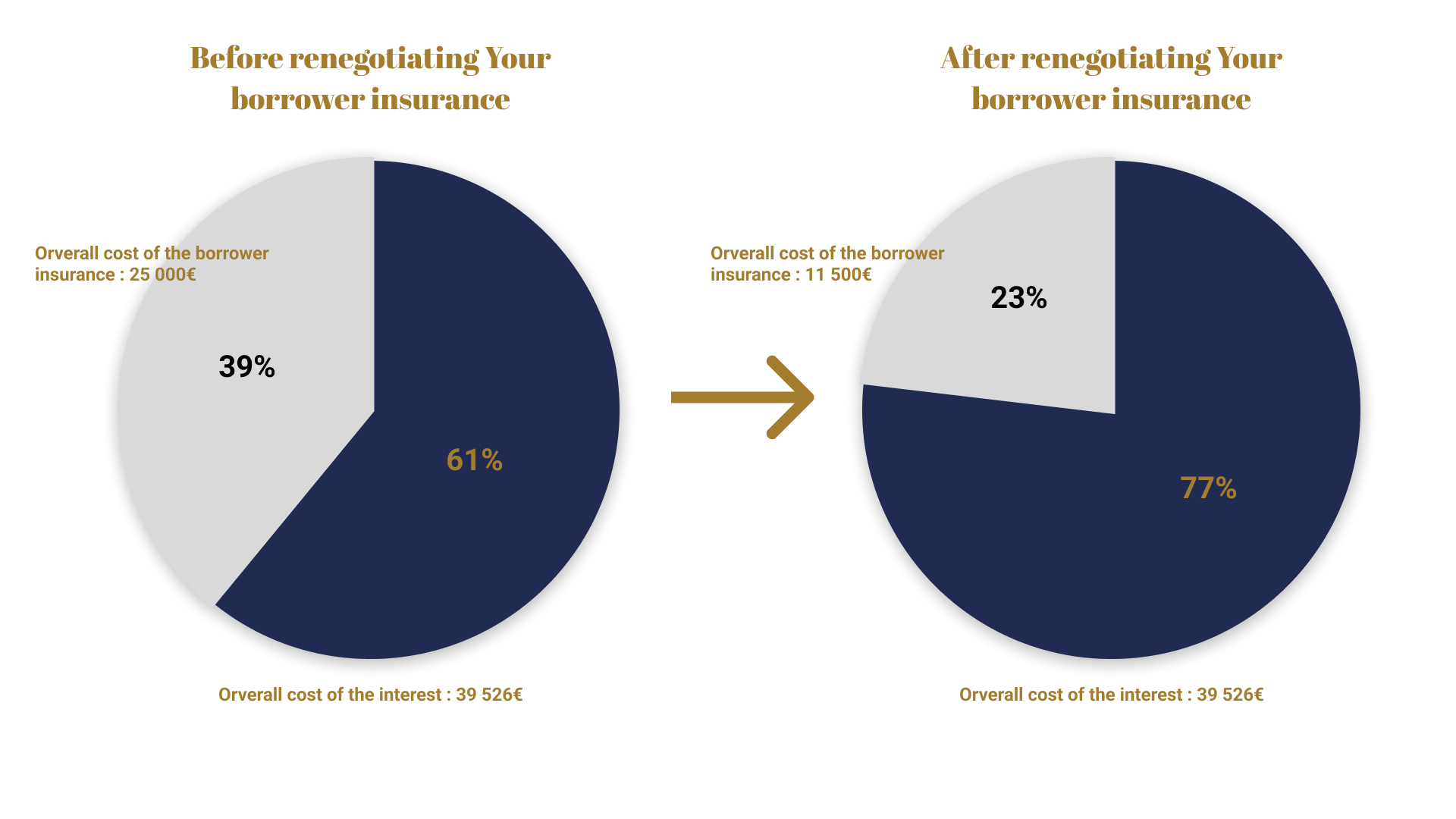

Let’s look at an example to better understand: Mr. and Mrs. Dupond borrowed for the acquisition of their main residence, €250,000 over 20 years in 2021 at an interest rate of 1.5%. At the same time, they took out a loan insurance contract at a rate of 0.5%.

The new borrower insurance contracts are less expensive because the insurance companies refine the risks more so compared to the so-called group contracts, more global of the banking institutions, by proposing a health questionnaire and by requesting, according to the files, additional medical analysis.

4 good reasons to terminate your insurance contract and subscribe to a new insurance company:

- Reduce your monthly payments by up to 30% to 50% and benefit from savings of up to €13,500

- Maintain or improve the level of guarantees for your new contract

- Extend the insurance quotas to better protect your partner or spouse

- Be accompanied throughout the whole renewal process

How to benefit from the Lemoine law?

It is very easy, to save up to 15 000 € on your borrower insurance, click here

This was beautiful Admin. Thank you for your reflections.

Dear Ana, many thanks for your comment. If you have further questions, I am at your disposal. The borrower insurance laws in France (Lemoine Law) are not so well known. Clients can make a lot of savings and also extend their level of guarantees. Romain